Expert Tips, Insights And The Latest News.

Improve Your Financial Literacy And Financial Decisions

RBA downplays market expectations of rate cut amid chaotic US policy settings

The market is tipping another rate cut soon but the RBA is less convinced in a world of chaotic Trump-led [...]

Property affordability lurches from stress to panic

The average home loan now consumes more than half of the median family’s income, with affordability deteriorating at a startling [...]

Land Tax in Australia: A Comparison of Resident and Expatriate Obligations

Land tax is an important component of Australia’s taxation system, applying to the ownership of land and properties. It is [...]

Could 2065 be the year you pay off your home loan?

Home loans stretched over four decades could soon be normalised if the banks respond to a startling finding about just [...]

What are the extra costs of buying a home?

When taking out a mortgage, many people forget to consider the fees and expenses that come on top of the [...]

Regional NSW real estate set for a solid 2025

Strong population growth and a trickle rather than sea of city workers returning to the office points to a strong [...]

East coast investors creating two-speed Perth property market

he latest data from Lendi reveals that 37 per cent of all property transactions in the Perth metro area are being made [...]

Foreign property investment ban: gimmick or game changer?

Both sides of politics are turning their sights against foreign property buyers, but will a ban have any impact on [...]

Borrowers receive first interest rate cut in four years

Borrowers have been handed their first interest rate cut in just over four years, with the RBA slicing 0.25 per [...]

A loan when you don’t tick all the boxes

It can be difficult to think about a property purchase if you don’t meet all the criteria for a loan. [...]

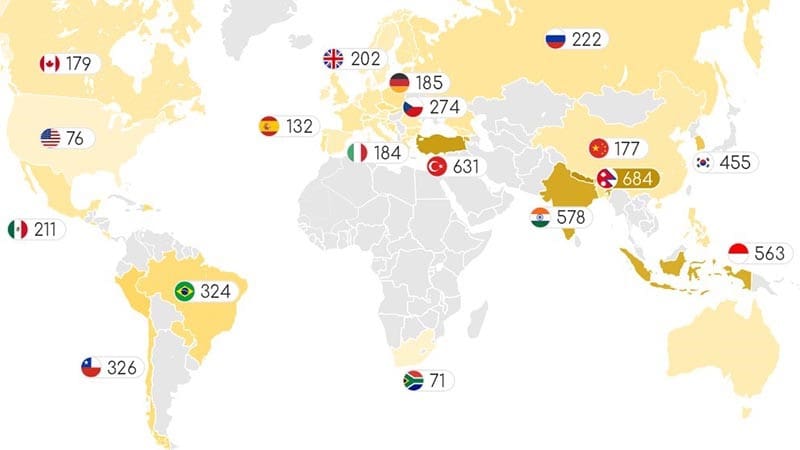

Compared to rest of world, Australian property buyers still in relatively lucky country

Australians are increasingly contending with unaffordable real estate slipping from their grasp but on a global scale things aren’t necessarily [...]

Perth’s hotspot suburbs among those poised to join $1 million club

Another 20 Perth suburbs are set to become new entrants to the million dollar median club in 2025, but among [...]

Mortgage stress on the rise: how to cope as a property investor

With more than 1.5 million mortgage holders deemed ‘at risk’ of failing to meet their mortgage repayments, having financial coping [...]

Revealed: the housing markets set to get the biggest jolt from interest rate cuts

If interest rates undergo a series of cuts, certain property markets will see a bigger boost from the reductions than [...]

Understanding and Managing Your Credit Score

When planning to buy property in Australia, you’ll find yourself juggling numerous numbers: the deposit you’re saving, your borrowing capacity, [...]

House flipping: eight top tips to profit from quick property turnarounds

Buying and selling properties in rapid succession to make a quick profit – known as flipping – comes with risks [...]

Competing forces divide opinion about property price direction in 2025

Higher listings are putting downwards pressure on property prices in the capital cities but the prospect of multiple interest rate [...]

Interstate investors target WA property but often lack market know-how

Property in Perth and regional Western Australia has been a magnet for interstate investors, but many are getting stung by [...]

Maximise Your Savings: Tips for Paying Off Your Australian Mortgage Faster

For many of us, a home mortgage represents our largest financial commitment, one that can stretch on for decades. However, [...]

Top 5 must-haves for the apartment buyer of 2025

A major shift towards apartment living is changing the way buyers are thinking about what they need in their more [...]

Inflation takes a tumble, with an interest rate cut now appearing certain

The latest eagerly awaited inflation data has shown a bigger than expected fall and delivered a forceful message to the [...]

Interest rates no deterrent to positively geared property investments

Despite higher interest rates, Australia abounds with locations where rental yields are well above average and capable of covering mortgage [...]

Student, casual worker or mum and dad investor, property is a viable option

Whatever your financial or career situation, there are strategies that can be employed to get a foot on the property [...]

How a broker can do the heavy lifting for you

It’s challenging buying property. It’s tough scraping together a deposit, it’s not easy dragging yourself to one open-for-inspection after another [...]

Save Faster for Your First Home

Everything you need to know about The First Home Super Saver Scheme (FHSS) We’ve got great news for Australian first [...]

Strong jobs numbers muddy the waters around potential rate cut

A strengthening labour market could deter the Reserve Bank from making an immediate cut to interest rates. Australia’s unemployment rate [...]

Securing a Loan in Australia as a Self-Employed Individual: A Guide for Expatriates and Foreign Buyers

Securing a home loan or Australian mortgage can be challenging for self-employed individuals, especially when they are also expatriates or [...]

Will national property price decline be a blip on the radar?

Property prices nationally have taken their first backward step in almost two years but the minor decline might yet prove [...]

What You Need to Know About Construction Loans

Building Or Undertaking Major Renovations On Your Home? Or are you an Aussie expat looking to build or renovate your [...]

2025’s hotspot suburbs for buyers on the average income

For the average income earner, it has never been so hard to buy a home but there are some relatively [...]

Shining a light on 2025’s property investment landscape

To maximise the prospects of investing successfully in property in 2025 pay heed to these eight pieces of invaluable advice. [...]

Investment property boom continues, while sellers haul in record profits

roperty price growth may be slowing but an investor boom is still unfolding in Australia. Loans to real estate investors [...]

Perth’s past two decades of property price movements offer investment lessons

Looking in the rearview mirror at Perth’s previous 20 years of property price growth and occasional declines, there are valuable [...]

A helping hand to make a successful purchase

If you are looking to buy property next year – congratulations! You have an exciting but somewhat challenging time ahead [...]

Surprise fall in jobless rate lessens likelihood of rate cut

Hopes of an imminent interest rate cut have been dashed by shock new unemployment data that showed the jobless rate [...]

No festive season interest rate reprieve for stressed borrowers

Mortgage stress is at an alarming level but the RBA was above such considerations in keeping the interest rate on [...]

Preparing for property success in the new year

The new year is a time when most people sit back and set some goals for the year ahead. But [...]

Investors flocking to Western Australia’s booming property market

Capital growth, high rental yields and a strong economy have ked to new investor loans in Western Australia soaring. Western [...]

Mortgage repayments chomping away at half of household income

Housing affordability has hit a historic low with mortgage repayments now consuming almost half of household income but there are [...]

The mid-priced home for Joe and Jill Average has just hit $800,000

Even as national property growth eases, the median dwelling value in Australia has hit eye-watering record levels. If you want [...]

The national property boom is over

National property prices are now almost flatlining, with the pace of growth slowing in the strongest markets and going backwards [...]

Looking to buy Australian property in 2025?

Here’s What Expats Should Know! As mortgage brokers, we’ve seen firsthand the unique challenges and opportunities faced by Australian expats [...]

Award-winning mortgage specialist on offsets, redraws and renovation financing

Whether it’s a new or refinanced home loan, or the need to fund a major renovation project, well informed decision [...]

Biggest property price gains are outside the capital cities

The hottest property markets in Australia are not spelt in capitals; it’s regional real estate that is outperforming the nation’s [...]

2025 property market boom or bust dependent on interest rates

An expected interest rate cute in early 2025 could result in another property market boom, but the likes of Canberra, [...]

Sorting Mortgage Facts from Fiction with Specialist Mortgage

With so much chatter about the Australian property market, it’s easy to get lost in the noise. You’ve likely heard [...]

How much should you be spending on your mortgage?

There’s a gaping chasm between the proportion of income that is deemed comfortably manageable and the amount the average Australian [...]

Another year, another title!

We’re thrilled to celebrate a remarkable achievement for Helen Avis, who has once again solidified her position as one of [...]

RBA resists urge to gamble on a Melbourne Cup Day rate cut

The Reserve Bank of Australia has kept interest rates on hold at its Melbourne Cup Day announcement. The Reserve Bank [...]

The facts every property investor should know about investment loans

First-time buyers of an investment property need to be aware of the pros and cons of the different loan types [...]

Inflation returns to RBA’s preferred range for first time since pandemic

Inflation has fallen to its lowest level since the Covid pandemic, raising hopes among borrowers that interest rate cuts could [...]

Property market tipped to soften in 2025

For almost two years, national property prices have recorded month-on-month gains but 2025 could present a different story. Despite property [...]

The timeless battle between old and new properties as an investment

Weighing up whether to buy or build is a choice that comes with its own set of advantages and disadvantages, [...]

Specialist Mortgage’s Helen Avis Shortlisted for 2024 Women in Finance Awards

Helen Avis has been nominated for Mortgage Broker of the Year. Specialist Mortgage is proud to announce Helen Avis, Director [...]

The secrets to developing a successful property investment strategy

Investing successfully in property is relatively simple but with the cost of living at record highs due to rampant inflation [...]

A Finalist Once Again in the 2024 SFG National Awards

At Specialist Mortgage, we are thrilled to announce that Helen Avis, our Director of Finance, has once again been recognised [...]

Australian expat tax considerations & Australian property market update

Australian property has been an effective tax planning tool for Aussie expats for many years. However, recent changes to [...]

RBA crushes hope of a 2024 interest rate cut

A few months ago their was widespread optimism that interest rates would be in retreat by Christmas but the RBA [...]

Perth’s million dollar property club explodes

Perth’s million dollar property club has expanded in spectacular fashion, with a record number of suburbs moving into this rarefied [...]

Celebrating Excellence: Specialist Mortgage and Helen Avis finalists in the 2024 Australian Mortgage Awards.

The Excellence Awardees have been announced for the 2024 Australian Mortgage Awards, the biggest showcase of excellence in the region’s [...]

Perth, Brisbane dominate hotspot suburbs being targeted by investors

Property investors are most active in Australia’s fastest growing property markets but there are a string of surprise packets among [...]

Is it worth buying an investment property in a self-managed super fund?

Adding property to the mix in a self-managed superannuation fund (SMSF) can offer enticing tax benefits but comes with an [...]

Could a share market crash cause a property price collapse?

Stock markets around the world have rattled investors over the past week but could a major crash wreak havoc upon [...]

Sigh of relief from borrowers as RBA makes its marginal call

The Reserve Bank of Australia (RBA) has kept the cash rate on hold at 4.35 per cent despite persistent inflation [...]

Three-bedroom house to car parking bay; what can investors get for $250,000?

Property buys for $250,000 or less come with their own quirks and nuanced investment profile but whether it’s a serviced [...]

Three cities go backwards as national property price momentum eases

Three cities are booming and three are going backwards as overall momentum in the property market eases and inflation presents [...]

Investors pour back into market as first home buyers squeezed out

Property investors continue to plunge back into the market, far outstripping the pace of new loan growth among owner-occupiers and [...]

‘Buy property now’ as prices, costs are only going one way

With property prices high around the country and building costs not subsiding significantly any time soon, do prospective property buyers [...]

Interstate property investment deluge in Perth

East Coast investors are drawn to the perfect storm that is pushing up Western Australia’s house prices faster than in [...]

Bank of Mum and Dad – how much help is too much?

Parental support for children trying to get a foot on the property ladder is gaining more traction every year but [...]

Smart property buyers want an A, not a C grade

If you don’t know what proportion of a property’s value should be land, or the difference between A-grade and investment-grade [...]

Australia’s top 20 affordable property investment locations revealed

Locating the best prospective property investments without breaking the bank is difficult with prices having risen so sharply, but this [...]

Helen Avis: Finalist for the Australian Broking Awards 2024

Helen Avis, Director of Finance at Specialist Mortgage, has been named a finalist in the Residential Broker of the Year [...]

Ten hottest suburban property markets for 2024 are in one city

Property prices in Perth are defying a gradual easing in the rate of capital growth being seen elsewhere in the [...]

Foreign buyers hit by changes to NSW land tax rules

The removal of a land tax exemption for a string of nationalities could prove costly for international buyers and have [...]

With property prices still rising, how should the RBA respond?

Interest rate rises would ordinarily push property prices down, but real estate and rents are still going up, adding to [...]

Tax cuts increase borrowing power but could fuel inflation, property prices

Home buyers will be contemplating more expensive property purchases with their increased borrowing power, while mortgagees will be hoping to [...]

Inflation shock puts end to hopes of interest rate cut

Inflation to May 2024 has taken a stunning turn, rising sharply and effectively quashing any hopes of an interest rate [...]

Melbourne goes backwards, Perth prices rise $1,000 a day for a year

Australian property prices have “found their groove” in rising by between 0.5 and 0.8 per cent since February, with June [...]

Top five most tax-efficient assets for investment property renovations

A decade’s worth of data has uncovered the most lucrative plant and equipment assets to consider when renovating an investment [...]

Winner of second Residential Broker of the Year award has advice for cash-strapped home buyers

The Mortgage and Finance Association of Australia named Ms Avis Residential Finance Broker WA 2024, marking her second time atop [...]

The impact of seasonality on property investing

Property buyers and sellers alike stand to save potentially big dollars if they time their property purchase right in relation [...]

Bombshell ATO report reveals foreign property buying soars

Foreign property buyer numbers have taken off, with international real estate investors shaking off their post-Covid blues and turning their [...]

Property prices tipped to hit record levels in two-speed market

Property price growth is forecast to hit record median dwelling value levels in a majority of property markets around the [...]

RBA holds steady but may have some surprise moves to come

Commentators were unanimous in their expectations the Board would sit tight in the face of stubbornly high inflation but is [...]

A first home buyer’s state-by-state guide to grants and stamp duty concessions

Queensland, South Australia and Tasmania have in the past week made changes to their stamp duty and first home buyers [...]

Road still bumpy for renters, borrowers on Struggle Street

A slight improvement in vacancy rates has done little to quell the rental crisis, while a disturbing proportion of home [...]

How to determine a property’s investment potential?

Buying a property for investment purposes is a different prospect to purchasing the dream family home, and addressing key parameters [...]

Investing in Australian Property as a Foreign Buyer

Investing In Australian Property As A Foreign Buyer Can Be An Attractive Opportunity! Given the stability and potential for growth [...]

Purchasing Australian Property and the implications of Tax, what you need to know.

Helen Avis of Specialist Mortgage discusses what you need to know. Resident vs. Non-Resident Australian Tax – What Is The [...]

Securing a Loan in Australia as a Self-Employed Individual: A Guide for Expatriates and Foreign Buyers

Your 2024 Guide for Expatriates and Foreign Buyers Securing a loan in Australia can be challenging for self-employed individuals, especially [...]

Your guide to non-conforming home loans in Australia

Helen Avis Of Specialist Mortgage Demystifies Non-Confirming Home Loans In Australia. What Is A Non-Conforming Home Loan? Non-conforming loans, also [...]

20th Annual Australian Budget Review 2024

20th Annual Australian Budget Review 2024 On May 14th Treasurer Jim Chalmers delivered the 2024-25 Federal Budget, with a central focus [...]

Navigating the Property Market in Australia (2024)

Insights From Your Mortgage Broker, Helen Avis Of Specialist Mortgage Entering the new year, we are flooded with predictions and [...]

A Guide to Buying Australian Property as an Expat

Your 2024 Guide How To Make Buying Australian Property As An Expat As Easy As 1, 2, 3? For Australian [...]

Unlocking Financial Wisdom

How to make your offspring financially savvy. Unlocking Financial Wisdom at any age, the Top 6 things you can impart [...]

Off-the-Plan Finance for Australian Expatriates

Your 2024 Comprehensive Guide To Off-the-Plan Finance For Australian Expatriates Investing in off-the-plan properties can be an attractive option for [...]

What are the top 8 factors you need to consider when buying Australian Property in 2024?

Specialist Mortgage’s Top 8 Factors For 2024 Buying a property in Australia can be a significant milestone and a complex [...]

Helen Avis – MFAA Residential Finance Broker Award Finalist WA 2024

Congratulations Helen for being announced as one of five finalists in the running to win MFAA State Excellence Award for [...]

Six property experts reveal their Sydney investor hotspots for 2024

Six Sydney property experts reveal the suburbs and property types real estate investors should be looking to buy in 2024. [...]

Slash mortgage by 6.5 years – and six other ways property managers can boost cash flow

Our Top tips to slash that mortgage in 2024 From cutting years off the length of a mortgage to maximising [...]

When Is It a Good Time to Refinance?

Our Top 5 2024 Tips For Accessing If Its Time For An Update To Your Home Loan. Refinancing a home [...]

Perth top 10 suburbs eclipse 30 per cent growth, as investors dig deeper for value

Our Top 10 Suburbs To Watch In 2024 Perth property prices are soaring but investors are contending with the high [...]

Leading WA brokers honoured at Better Business Awards 2024

Twenty members of the Western Australian broking industry including our very own Helen Avis have been declared as winners at [...]

Award-winning broker predicts strong property market performance in year ahead

With a multi-generational client base that now includes the children of her original property buyers, Specialist Mortgage Director, Helen Avis, [...]

When Is It Not a Good Time to Refinance?

Our Top 5 2024 Tips For Accessing If It’s Best To ‘Stay Put’ With Your Current Home Loan. Refinancing a [...]

Borrowers on edge over future rate cuts

Experts are divided on the likelihood of an RBA interest rate cut in the next few months, but all agree [...]

Investors, first home buyers piling back into the market

Investors and first home buyers are making a big return to the property market, with three state capitals seeing particularly [...]

A new year brings some positive inflation news!

In comparison to the warm weather of November there was a considerable cooling of inflation indicating benefits for all of [...]

What is the hottest property market in Australia?

With housing affordability at its lowest level in three decades thanks to higher cost-of-living pressures, interest rate raises and healthy [...]

Decoding the Mortgage Landscape: A Year in Review of Australia’s Home Loan and Property Market

As we stand at the crossroads between the past and the future and bid farewell to another eventful year, it’s [...]

The benefits of engaging a Mortgage Broker

In the complex world of real estate, purchasing a home or investment property is a significant financial decision. For most [...]

Breaking Ground: The joy of recognition and empowerment

I pen down this note with great enthusiasm and a deep sense of gratitude for the recent acknowledgment that has [...]

As savings fall home ownership remains the pathway to happiness, data reveals

At a time when the household saving to income ratio declined to its the lowest level in 16 years, new [...]

Unlocking Happiness: The Aussie Dream of Homeownership

In the pursuit of happiness, there’s a special kind that comes from owning your own Aussie home. As a Mortgage [...]

When is the best time to buy Australian property?

Published 30 November 2023: anza.org.sg Now is the time to buy Australian property. Here are tips to help you maximise [...]

Deposit shock for Sydney, Melbourne, Brisbane first home buyers

In just three years, the time it takes the average first home buyer to save a house deposit has leapt [...]

Unveiling Success at the SFG National Conference and Awards in Port Douglas

In the dynamic realm of finance, attending industry conferences is not just an option; it’s a strategic move towards growth, [...]

Kiwis, Chinese keen to buy Australian property

International buyers are still eyeing off Australia as a great place to invest in property with New Zealanders the most [...]

Celebrating Success at the Australian Mortgage Awards 2023

In the world of mortgage broking, the Australian Mortgage Awards are an unparalleled recognition of excellence and innovation, celebrating individuals [...]

Helen Avis has been shortlisted for the Women in Finance Awards 2023

The Women in Finance Awards 2023 is an exciting nationwide recognition program showcasing the outstanding women and businesses positively shaping [...]

Perth’s property sector steady despite stock shortage

The Perth property market still holds plenty of appeal for investors although a lack of quality stock is proving a [...]

Women leading the charge across the finance sector

Specialist Mortgage, a leading name in the mortgage broking industry, continues to make waves not only for its exceptional financial [...]

Six reasons a mortgage broker is a key part of any investment strategy

Mortgage brokers are an intrinsic component in any real estate investment strategy, says award-winning finance expert from Specialist Mortgage, Helen [...]

Three tips investors must know before renting out their property

A leading property management expert has identified three key areas landlords can address to ensure they get off to the [...]

With half of all borrowers in severe stress, is relief in sight?

While the pause in interest rates has come as a relief to many, everyone from first home buyers to owner [...]

Overcoming mortgage stress sometimes requires a helping hand

Life can present unexpected challenges and financial difficulties are a common concern. So, what can a mortgage broker do for [...]

RBA Governor Lowe bows out leaving interest rates unchanged

The Reserve Bank Governor Philip Lowe has used his final monthly meeting to leave interest rates on hold for a [...]

At the midway point, are we climbing or falling from the mortgage cliff?

With the mortgage cliff around the halfway point of its gradual transition from low fixed to high variable rate loans, [...]

Experts in Excellence

SMATS Group was recently featured in ANZA Singapore 75th anniversary issue magazine. Click here to view the double page spread on page [...]

Property Prices Continue Recovery But Headwinds Lurk

Australia’s property market has clocked up a fourth straight month of home value increases, with Sydney again leading the way, [...]

Specialist Mortgage takes out coveted finance broker title

Specialist Mortgage, part of the SMATS Group, won the prestigious Finance Broker Business Award WA category in the Mortgage and [...]

Ideal time to refinance, according to coveted award nominees

While record numbers of mortgagees are refinancing, it’s still a small proportion of overall lenders at a time when significant [...]

Specialist Mortgage director triumphs in Better Business Awards

Helen Avis, Director, Specialist Mortgage, has added another accolade to her impressive list of achievements, this time securing the Western [...]

Borrowers getting creative as they wrestle with rising interest rates

Interest rates being pushed up by rampant inflation are forcing mortgagees and prospective buyers to find new ways of servicing [...]

Mortgage cliff piling stress onto borrowers

Borrowers are refinancing in record numbers as their lower-priced fixed rate loans end, only to be switched to higher priced [...]

Specialist Mortgage In Running For Multiple Better Business Awards

The finalists for The Adviser Better Business Awards 2023 have been named, with Specialist Mortgage and its finance director in [...]

National champion broker in running for Women in Finance Award

In what has been a rewarding and productive 2022 for Helen Avis, the Specialist Mortgage Director has added a finalist [...]

Newly crowned residential broker of the year optimistic despite rate hikes

Helen Avis, winner of the prestigious MFAA Residential Finance Broker Award, said interest rate concerns were beginning to weigh on [...]

Specialist Mortgage broker named best in the west

Specialist Mortgage Director, Helen Avis, has been named winner of the WA Residential Finance Broker Award at the annual Mortgage [...]

RBA lifts rates – so is it time to refinance?

With the Reserve Bank of Australia set to raise rates throughout 2022 and the banks following without hesitation, is it [...]

Specialist Mortgage And Staff Among Finalists For Coveted Industry Titles

Specialist Mortgage and its Director, Helen Avis, have both been announced as a finalists in the WA Finance Broker Business [...]

Acclaimed broker says expat buyers undeterred by rates, prices

Undeterred by property prices in Melbourne and Sydney coming off the boil or the threat of higher interest rates, expatriate [...]

Top Of Her Game – Perth Broker Lands Top 25 Mortgage Broker Of The Year

Specialist Mortgage finance director Helen Avis has been recognised in this year’s MPA Top 100 list, as one of the [...]

Top broker settles $25 million in loans in one month

Specialist Mortgage director Helen Avis settled more than $25 million in loans in July, as returning expats and those looking [...]

What you need to know when applying for an investment loan

Applying for finance as a first-time investor can be a complicated process that features several subtle differences from obtaining a [...]

Buying property with rates at 0.25%

There might be plenty of uncertainty in the air at the moment on the back of the coronavirus, but one [...]

COVID-19 Mortgage Relief

Covid-19 is having an ever-changing impact on many things for all of us, with travel and movement restrictions, self-isolation, business [...]

Off-The-Plan Finance For Expats

Living overseas as an expat can be a fantastic move financially and can allow you to progress up the property [...]

Is It Time To Tap Your Equity?

By leveraging the equity in your current property, you can quickly take that one property…and build a portfolio that can [...]

The Power Of Leverage – Using Equity To Build Your Portfolio

One of the most powerful things about investing in property is your ability to leverage the equity in your existing [...]

Financing Your Off-the-plan Purchase

Buying an off-the-plan property is a great way to enter the property market, but there are a few considerations you [...]

Financing your land and construction project

Whether you are hoping to create that dream home or looking to make a solid investment, purchasing a block and [...]