- 21 Dec 2023

- By API Magazine

With housing affordability at its lowest level in three decades thanks to higher cost-of-living pressures, interest rate raises and healthy property prices, Perth’s property market is proving a standout.

Helen Avis, director of specialist mortgage at brokerage SMAT Services, said Perth was experiencing a massive boom generated by younger home buyers, with housing affordability better than it was in the late 2000s and early 2010s during the height of the mining investment boom.

Avis (pictured above left) said young home buyers had shown an increased interest in the property market during the pandemic.

First home buyers drive demand in Perth, Brisbane

“Low interest rates, First Home Owner Grant, First Home Loan Deposit Scheme, and the WA off-the-plan rebate had attracted first home owners to make the leap into homeownership,” said Avis, who won Pepper Money Broker of the Year – Specialist Lending at the 2023 Australian Mortgage Awards.

“But post pandemic there has been a marked decline in first home buyers in Sydney and Melbourne, which we put down to affordability, rising interest rates and the difficulties of saving for a deposit.

“The opposite can be said about Brisbane and Perth, where there is still strong demand from the first home buyer market.”

Julie Kelley, sales and marketing manager at national real estate group aussieproperty.com, (pictured above centre) said across Australia there had been an increase in the number of first home buyers attending open homes with their parents, indicating the bank of mum and dad could be the key to entering the market.

East Coast Investors Buying Lower-Priced Perth Property

However, Kelley said Perth property in the lower price range, particularly in the outlying suburbs, was being snapped up by east coast investors.

“Unfortunately, this is resulting in first home buyers facing more competition for homes priced under $600,000 and they are being forced to broaden their search to the outskirt suburbs or consider buying smaller apartments and cottage homes,” Kelley said.

“The biggest increases in enquiries are from investors and buyers looking to upgrade their homes.

“There has been an enormous increase of interstate interest in Perth real estate particularly from Sydney and Melbourne.

“We have also seen a record night numbers of interstate migration and given Perth’s vacancy rate of 0.9% it’s difficult to secure rental properties, so many cashed up eastern states’ migrants are looking to purchase. “

Avis said many interstate buyers were guided by buyers’ advocates with limited local area knowledge or by big data, which could lead to poor long-term investment decisions.

“Off-the-plan developments hasn’t been popular for the past 12 months mainly due to the risk factors associated with the current state of the building and construction industry,” Avis said.

“Inner city suburbs and the western suburbs are still the most desirable locations for owner occupiers and investors, the north west coastal suburbs are also very popular.

“They are well established suburbs, close to the river and ocean, have excellent amenities, recreational facilities and public transport to the CBD and universities.”

A recent PropTrack Housing Affordability Index 2023 report highlights just how dire affordability is now particularly in NSW, Tasmania, and Victoria, with Perth the most affordable state in Australia.

“That is a marked change from a decade ago, when Western Australia was the least affordable state from 2007-2010 amid the height of the mining investment boom,” the report states.

“[This is] the only time any state has displaced NSW as the least-affordable state.”

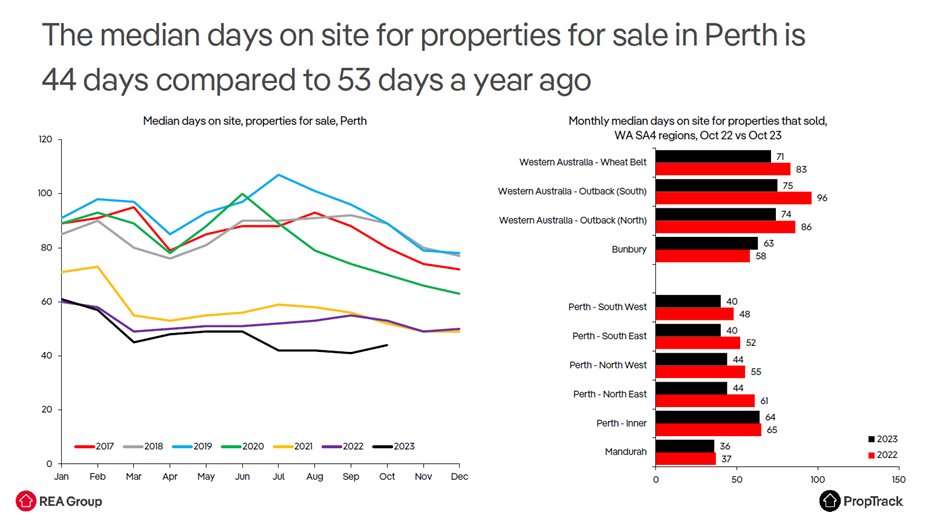

Houses in Perth were sold at a median rate of eight days in October, setting a new record and nearly twice as fast as the 15 days recorded in October 2022, according to the Real Estate Institute of Western Australia.

Warning Over Lower Priced Properties

Peter Gavalas, a buyer’s agent from Resolve Property Solutions, (pictured above right) cautioned that fierce buyer competition amid the booming Perth property market could see some buyers settle for low-quality properties that they might one day regret owning.

“The bottom line is that, right now, the Perth property market doesn’t have enough supply to cater to all the demand,” Gavalas said.

“So buyers are reacting the same way they do in any boom – they’re compromising on quality, by settling for less desirable homes, such as ones with structural problems, or less desirable locations, such as on noisy main roads, because they fear they’ll never enter the market any other way.”

Gavalas said even though buyers were experiencing FOMO, it was likely they would suffer a case of buyer’s remorse in the years ahead if they compromised on quality.

“A better option would be to buy a higher-quality property with stronger resale value in a cheaper neighbouring suburb,” Gavalas said.